Award-winning PDF software

4-h Horse Lease Agreement Form: What You Should Know

In this Agreement, the definitions and explanations as well as the term “lease” are as follows: “A 4-H Horse Association Member shall not be deemed a “horse owner” until and shall the terms of this Agreement have been properly executed before the 4-H Horse Association Member. This agreement will be subject to review by the Board of Directors at its next meeting and amendments may be made or modified by the Board of Directors.” (Click on a link to view the 4-H Horse Lease Agreement.) Iowa Student 4-H Horse Lease Agreement: (download it in PDF format) Included in all new agreement contracts are a few details about your new co-ownership of your new friend. Iowa 4-H Horse Lease Agreement (back to top) Iowa 4-H Horse Lease Agreement (back to top) If you're a 4-H member, then you need to contact your local Board of Directors for the forms. If you're an individual interested in having a 4-H event in your community, then you'll first have to acquire a Horse ID and Registration Fee, which cost 40.00 for each individual who will register a horse, 75.00 for the entire event, and 70.00 for each student registered. Registration also requires a 75.00 fee to be held off-campus (or in the community) in the 4-H Horse Association office. The fee covers registration, horses, the horse barn, fencing, and insurance, all covered by USAGE. Once the individual and the co-owner/owner of the event is done with all that's required, they must pay the total. The Horse ID or registration and fee must be paid in person at the National Headquarters, 3135 Old Highway 3, Urbana, IA If you aren't a member or student, but would like to be considered for a 4-H license, click here. Note that you will be asked to sign a declaration of coexistence or non-existence that states that you “will not possess, use, or compete in a show or other competition for the benefit of an exhibition horse in any sport, exhibition, or commercial display held for profit by any person, organization, or business entity or a Horse Center, unless you are under contract with an exhibition horse show owner to exhibit or utilize your horse under their auspices.

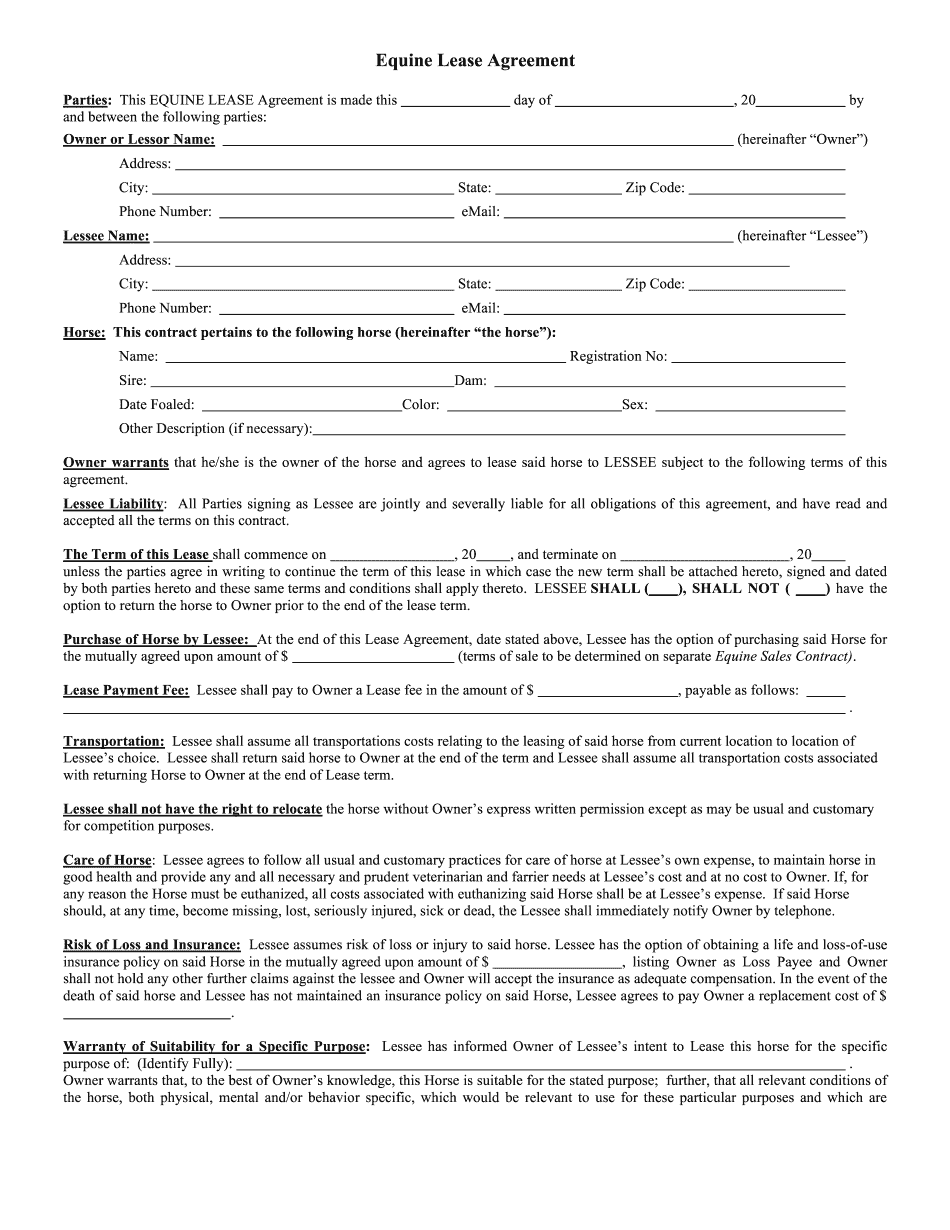

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Equine Lease Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Equine Lease Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Equine Lease Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Equine Lease Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.