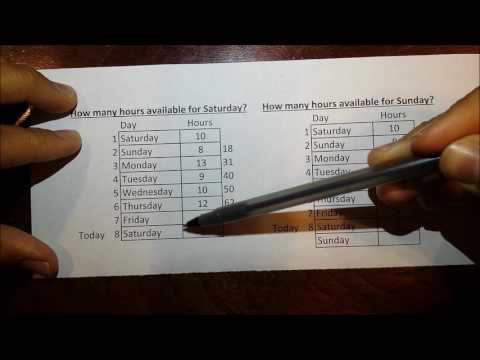

On this video, we're going to learn how to check the 70-hour a day rule. As you know, on each log, we have a recap. Many of us ignore this, but if you are a driver who will be driving over 3,000 miles, it is highly recommended to use this section to keep track of your weekly hours. If we look here, we have already learned about the three daily rules, but now we're going to focus on this rule, the 70 hours in a day rule. Many companies, including ourselves, go by the 70-hour a day rule. Other companies go by the 60 hours in seven days rule. You have to remember that we go by this rule right here, 70 hours in eight days. Now, let's see what gets counted in this 70-hour a day rule. The 70-hour a day rule counts all driving time and all on-duty not driving time. The only way to reset a 70-hour in a day rule is with 34 hours off duty or in the sleeper berths. The 70-hour a day rule is similar to the 14-hour rule. The 70-hour a day rule states that a driver may not continue to drive a commercial motor vehicle if 70 hours of work have passed in the last eight days, starting from the present day. I have a couple of examples here. Let's say we have these logs, and from each log, we calculated the driving and on-duty not driving times and added them together. We got the totals of each day here. On Saturday, we drove and were on duty not driving for a total of 10 hours. On Sunday, 8 hours, and so on and so forth. Now, here it asks us a question: How many hours are available for Saturday? If...

Award-winning PDF software

Horse 4 h Form: What You Should Know

H Horse Project Forms & Rules — 4-H Horse Association. 4-H Horse Program. Volunteer Forms • Project Handbook -4-H Horse Program Project Handbook of the 4-H Horse Project. 4-H Horse Program Registration Forms. 4-H Horse Program forms, forms & rules for the Youth & Parent Program, Project Horse, Adult Horse program, Master of Ceremonies, etc. 4-H Horse Programs — 4-H Horse Project Registration Forms. (These forms and forms for the Youth & Parent program will be posted shortly. These will include the 4-H Horse Certificate of Registration as well as the 4-H Horse Registration and Permit Fees. This page will be updated as we receive more of these forms.) The following links will open a new web page.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Equine Lease Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Equine Lease Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Equine Lease Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Equine Lease Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Horse 4 h