Award-winning PDF software

Boarding Lease Agreement Form: What You Should Know

What if I sublet a room? How can I ensure compliance with the terms of the agreement? Can I negotiate for more? How can I be sure I am in compliance? Can I transfer, relet or change an agreement? Please review these important topics before you finalize your agreement. Use this guide to help you draft a contract that works for you and your family. The Residential Tenancy Agreement is a legal document that outlines the rights and responsibilities that all tenants (both landlord and tenant) have while living at the property. This agreement ensures that you all stay in compliance with the law and that everyone is treated fairly by the Property Manager. This document covers the following: Room rentals Renter's responsibilities Inventory control Maintenance or repairs Residential maintenance Notice and procedures Rent and lease termination No smoking rule No pets Duties of Leased Dwelling Unit LOST & FOUND Suspicious Animals Missing pets LATE PAYMENTS Refusing service Refusing to remove personal property Reckless damage False alarms Habitual late paying or non-payment of rent or damages to the property Reasons that make one tenant a tenant for life while leaving all others non-tenants Sections of the Residential Tenancy Agreement which specifically deal with one tenant Residential Tenancy Agreement — Article 3 Article Three No Person shall rent or sublease any part of the Premises at a rent or rate to be fixed or determined by the Board of Supervisors. Rental Agreement Lets take a moment to talk about how a Residential Rental Agreement might differ from a lease agreement. For Landlords The Residential Rental Agreement (hereinafter “the Agreement”) establishes the rules, responsibilities, and rights for tenants regarding the Premises. It contains the name of the Resident, the name of the Occupant, the rent, and the obligation of the landlord to maintain the Premises and comply with all local, state, and federal laws and regulations governing the Occupancy of the Premises. For Renter. The Agreement sets out the obligations of the Applicant and gives the Renter (hereinafter “the Tenant”) specific information about the Premises and the specific obligations of the Tenant. This is a legal document, just like a lease agreement, and the Tenant agrees to abide by the terms of the Agreement throughout his or her tenancy.

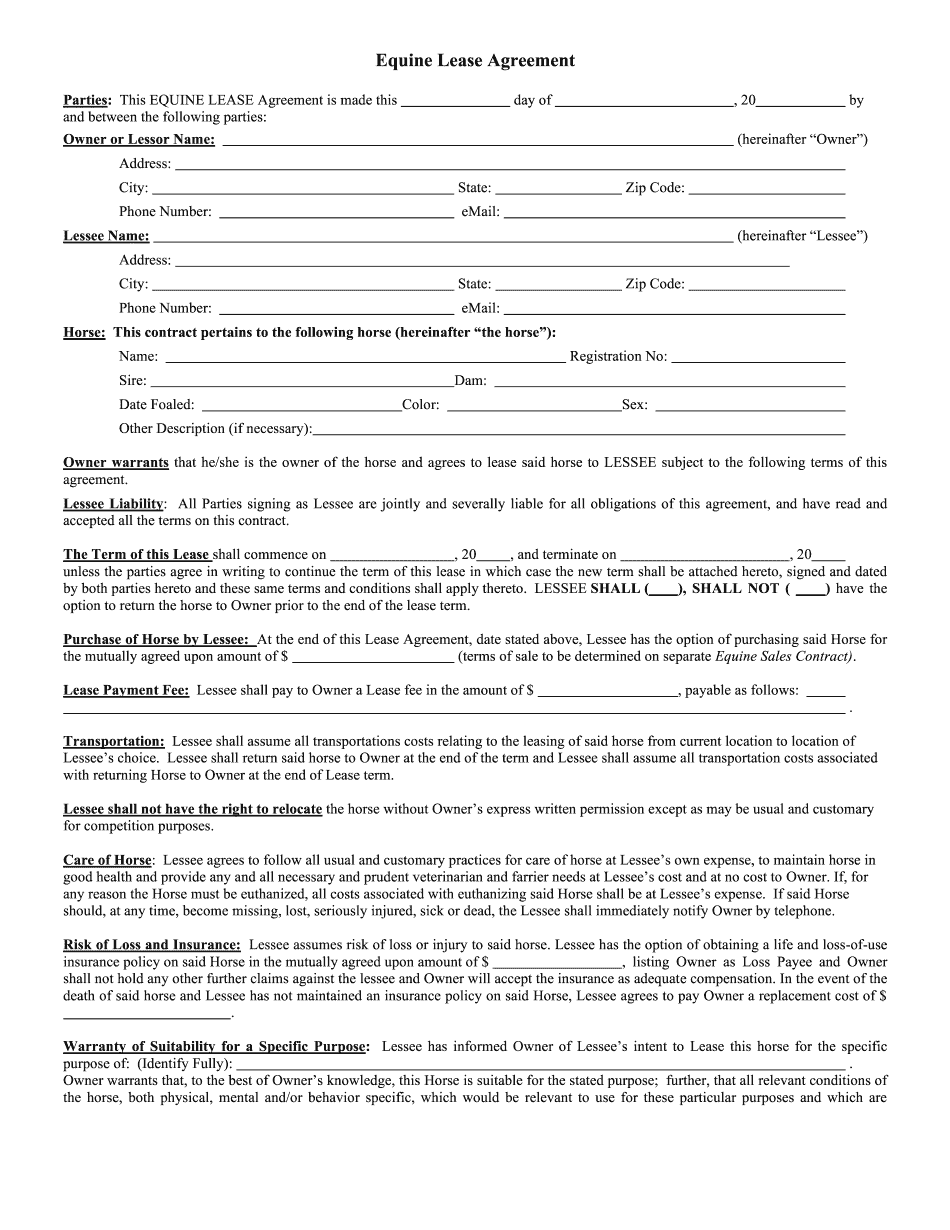

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Equine Lease Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Equine Lease Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Equine Lease Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Equine Lease Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.