Hello, it's Simon's Archie here, and I'm the author of "Property Magic," the property bestseller. I'm also the founder of the Property Investors Network, which is the largest organization of property network members in the UK. Our goal is to help you become a more successful investor. In this short video, I would like to explain the basics of purchase lease options. Purchase lease options are a great strategy that allows you to control property that you don't own. With this strategy, you can benefit from equity growth and cash flow without needing a big deposit or mortgage on the property. It may sound too good to be true, but this is one of the strategies we teach on our training programs. The concept is simple. There are people who have property that they don't want to own anymore. It may be mortgaged or debt-free, but they don't want the hassle of ownership. We step in and take control of the property through legal contracts with solicitors. This allows us to benefit from monthly cash flow and long-term equity growth. Let's imagine a scenario. Someone has a property worth £100,000, with a mortgage of £98,000. When they sell the property, after deducting legal and estate agency fees, they won't make any money. Realistically, they may only receive £95,000. This means they would need to put £5,000 of their own money to walk away from the property. Renting the property out may seem like a solution, but they may not want to deal with the hassle, cost, and risks of being a landlord. This is where we come in. We offer to buy the property at the full market price, but in the future, not right now. In the meantime, we will take on the property, paying a monthly fee to...

Award-winning PDF software

Horse free Lease Agreement with option to purchase Form: What You Should Know

LESSEE submits a leg-halo to LESSEE's designated agent.

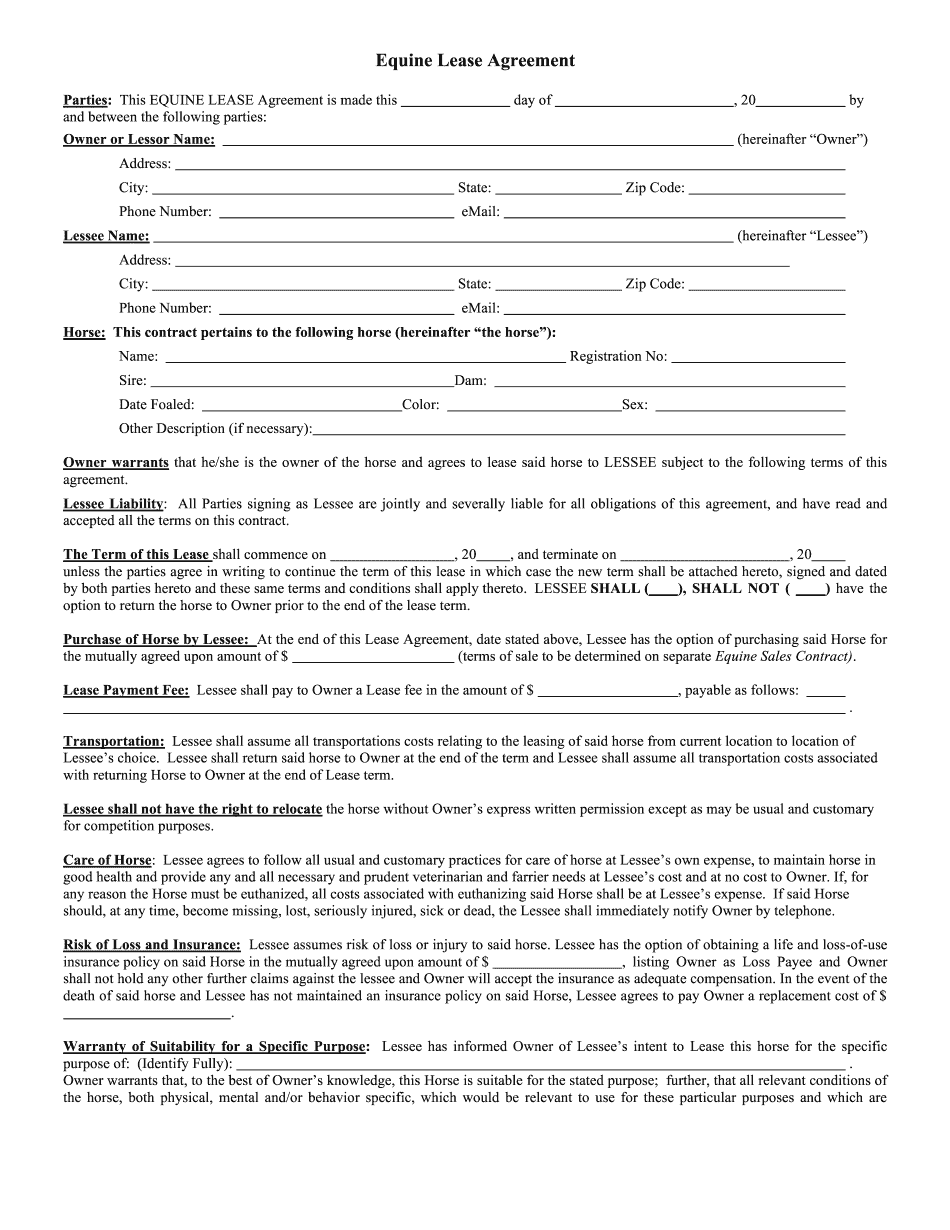

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Equine Lease Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Equine Lease Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Equine Lease Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Equine Lease Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Horse free Lease Agreement with option to purchase