Everybody, in here with REI Club, commonly silently, as a real estate investor. Today's quick video is about how to fill out a lease agreement. Like in all my videos, everything that I talk about is included in the description below. So, all you have to do is click the "show more" button and you can follow along. Now, I get asked all the time, "Frank, can I actually see real-life examples of the things you're talking about?" So, what I have in front of me right now is a lease agreement. Now, they do vary by state, but for example purposes, I have the one for Texas. I know that it may seem pretty daunting, and this document is actually 14 pages long with a lot to cover. Therefore, I will be emphasizing some focus points that you should go over with your tenants. The very first thing we need to talk about is on page 1, which is the parties involved and the property address. Next, on page 3, we address the term of the contract, when it is active, and when it expires. It is important to emphasize the expiration date so that the tenant is aware of when they need to notify you if they want to renew the contract or move out. If they fail to notify you, the contract is automatically renewed on a month-by-month basis. Moving on to page 2, we discuss the rent. This is where you include how much the tenant will be paying per month and also let them know that the rent is due on the first of every month. This makes things easier for you. Additionally, you should explain the prorated rate, which is important for tenants who move in the middle of the week. They should understand that the...

Award-winning PDF software

Farm building Lease Agreement Form: What You Should Know

Land adjoining the same and used for agricultural purposes, or land at the place of public use. (3) Land at the place of public use for the purpose of farming, ranching, or other agricultural use, when, under the provisions of law, any use at the same or adjacent to such place with respect to agricultural purposes is prohibited. (3) Land owned under an operating lease from a county board of recreation, when the land is required by the county board of recreation for purposes of a recreational park. (3) Land at the place of public use for recreational purposes when the county board of recreation has adopted a law prohibiting the occupancy, use or storage of tobacco on the land. (4) Land which is necessary to maintain the exterior safety of the property. (5) Land leased to the landlord as ancillary facilities on behalf of the owner of any such properties (4) Land leased to the landlord to be used for public recreation; (6) Land on which a building or facility for public recreation is contemplated, but not yet located. (7) Land that the parties shall exchange by sale, lease, gift or exchange of real and personal property when the owner desires to use it for the purpose for which it is leased; and upon such exchange, if the land is to be used as a public recreational building or facility, the tenant agrees to use it for the duration of the exchange, subject to the condition that the owner may use such land for his own agricultural purposes and that the parties agree to take all reasonable steps to ensure that the tenant does not operate the land on which he proposes to use it for an agricultural purpose. Rental Agreements. For Farm Buildings and. Livestock Facilities. This form is designed as, and intended to assist, the lessee, the owner or occupant of said property and shall provide a starting point for the negotiating process between the parties. Pages / Length: 4 Pages / Length: 1 Rental Agreement — Land For Good A rent agreement for this space is included as a sample. Rental Agreements. For Farm Buildings and Livestock Facilities. Page 1. Table (I) Rental Rate (1) A. A reasonable rental fee to be paid by the lessee. B. The actual monthly rent and any other reasonable increase in rent due to local rent laws. C.

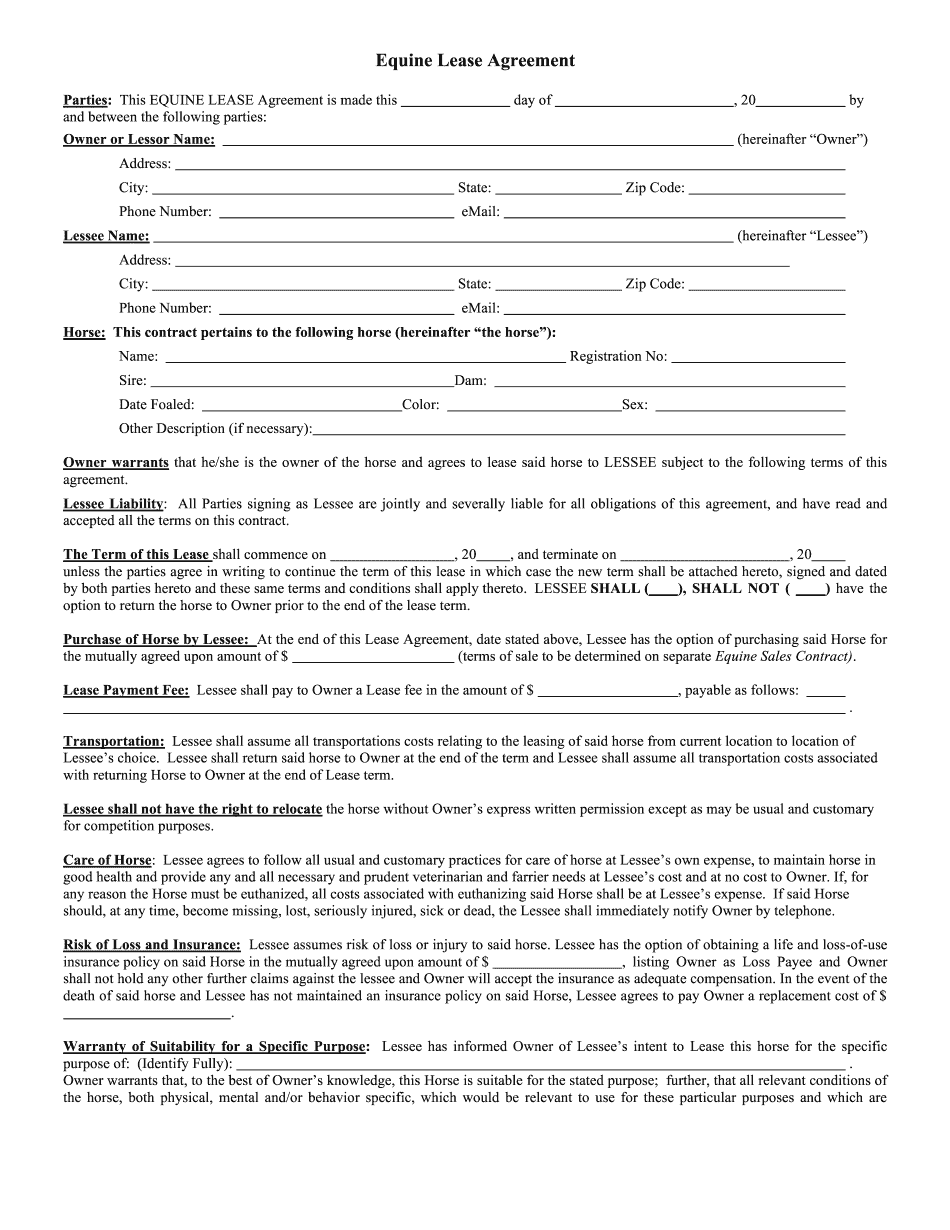

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Equine Lease Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Equine Lease Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Equine Lease Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Equine Lease Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Farm building Lease Agreement