So, speaking about contracts, let's talk about employment contracts for physicians. What should you do? Again, the unique thing is that nothing can happen unless you do something. You always have to keep it in mind, as this is a very unique industry. If you are signing up to be a doctor for a certain organization, they will need you a lot more than you need them because you're in high demand and only you can provide the service. Now, of course, there are other doctors, but when you have a position you've been hired for, only you can do it. No one else can. You should never be afraid of who you're talking to because they're gonna try and intimidate you, especially if you're a younger physician coming out of training. They will tell you things that basically suggest you don't understand or know how things work, and this is just the way it is. Well, that's fine. You can always take it home and think about it and assess your worth. The average age of a primary care doctor in San Francisco is 69, so that's good, and that's bad. It's good because, hey, they're still very healthy and practicing. It's bad because realistically, how much longer can they do it? Doctors are needed, doctors are in high demand across all specialties, no matter what you do. So you need to know your worth. And I don't know how many of you know this guy, and who he is is not important. His name is Ruff NetID, or he is a second baseman for the Texas Rangers. He's an average ballplayer. This is not the point. He did sign an extension a couple of years ago for $50 million, which in baseball terms isn't that much. His contract...

Award-winning PDF software

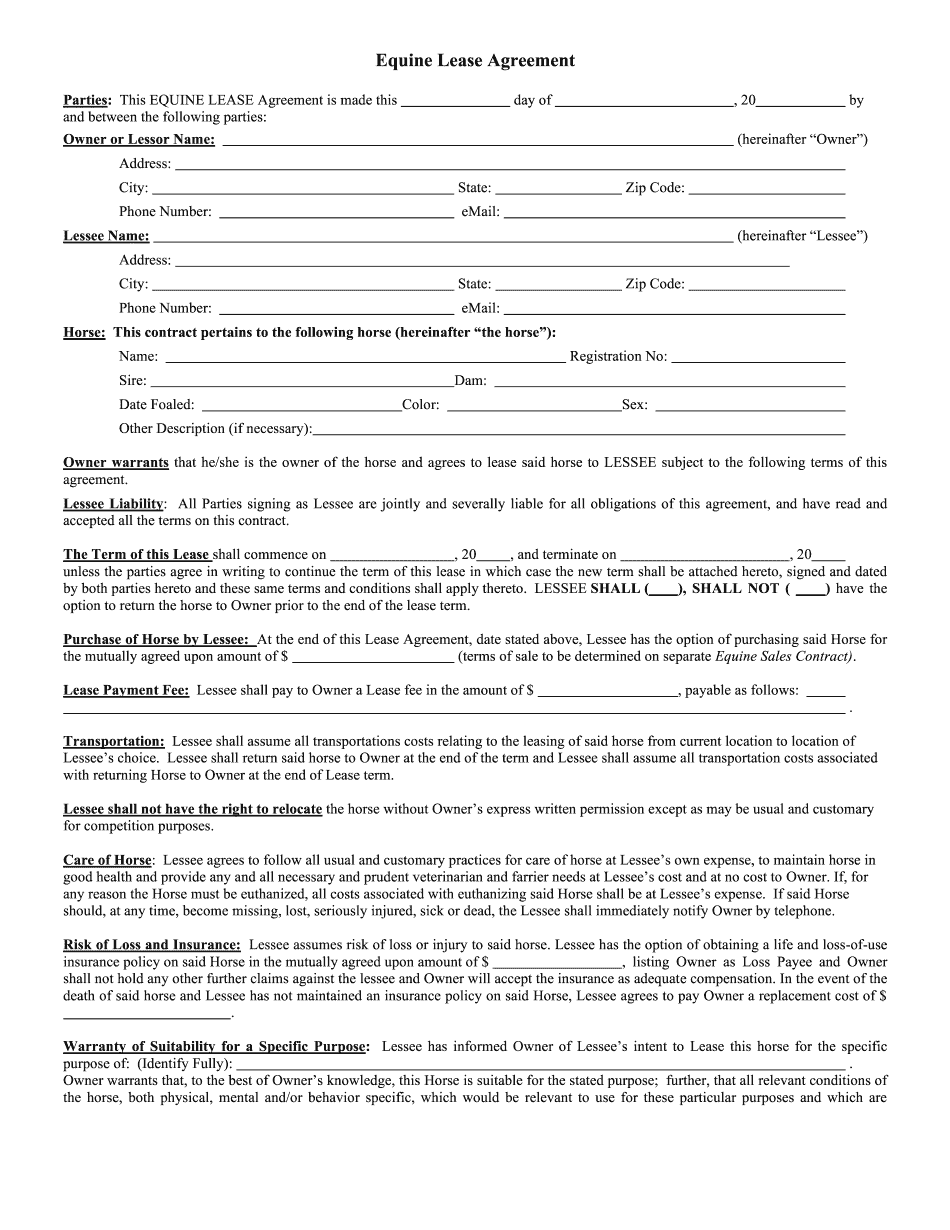

Horse Sale Contract with payments Form: What You Should Know

How to use: It's your obligation to read and understand all the forms that are printed in English before filling them in or signing them. The forms, instructions and related information is provided for reference.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Equine Lease Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Equine Lease Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Equine Lease Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Equine Lease Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Horse Sale Contract with payments